By Montezuma Cruz

Citizen Samuel Sales Saraiva suggested on Wednesday to the President of the United States that technical studies be carried out for the implementation of an executive federal measure that establishes a permanent 30% tax on all individual remittances over $200 per month sent from the United States abroad.

“I may stir controversy, but reality demands extra attention. I am inspired by the correct reading of the context within my possibilities, aware of the duty of exercising citizenship,” he said.

In a letter to Trump, with copies sent to immigration authorities, Saraiva, a resident of Washington, DC, outlines the use of the funds: “The revenue could be directed to ICE and other internal security agencies, enabling operations concerning intelligence, detention, custody, prosecution, and deportation, as well as salary bonuses for law enforcement agents.” ICE is the acronym for U.S. Immigration and Customs Enforcement.

“My proposal is undeniably reasonable, based on practical and historical reasons, with robust strength and legitimacy.”

“It is a fact that much of the money sent by immigrants to their countries of origin is earned illegally, as many individuals do not have a permit to work in the U.S.,” he claims.

A report by the Inter-American Dialogue highlights a 26% increase in the value of personal remittances sent by foreigners in the U.S., since surpassing $134.4 billion in 2021. In a reasonable projection, this amount would easily exceed $200 billion today.

“There’s nothing fairer than taxing international remittances and using these resources to improve training, provide better equipment, and financially compensate thousands of employees of our agencies, who carry out their meritorious duties with sacrifice, and under considerable risk, receiving less compensation than they deserve,” Saraiva advocates.

Tax Evasion

He also addresses tax evasion, stating that “it’s part of the DNA of people from backward cultures in which citizens and their representatives prioritize individual interests over collective aspirations.” According to him, this explains why “nations with immense potential for development remain stuck in chronic, secular poverty.”

Saraiva warns, “Although some studies indicate considerable tax revenue derives from illegal labor, the presumed tax evasion is incalculable due to the volume of cash payments fueling the informal market and causing significant losses to the national tax system.”

“At the same time,” he added, “this highlights the urgent need to adjust the fiscal system, making it equitable, just, and sustainable at the federal, state, and local levels.”

Given the damage tax evasion causes to various social levels, races, and ethnicities, Saraiva sees difficulties in adequately meeting domestic demands. “It’s worth pointing out that the United States leads the world in tax evasion, meaning an extraordinary amount of wealth is taken abroad,” he states.

According to some reports, international remittances sent by undocumented migrants worldwide surpassed $831 billion in 2022. A large portion of that sum was obtained by immigrants without legal authorization to work, meaning it’s undeclared money facilitated by the black market. Employers in many cases see themselves forced to cover these costs to avoid getting in trouble with tax authorities, or losing their workforce.

Saraiva says it is essential to eliminate the current possibility of making international remittances without providing a Social Security Number (SSN) or Taxpayer Identification Number (TIN), whether through wire transfers or transactions involving cards and cryptocurrencies.

Some services allow money to be loaded onto prepaid debit cards, which can then be used in international transactions. For those familiar with digital currencies, sending cryptocurrencies abroad is an option that often does not require an SSN. A parallel challenge is to prevent local money transfer services from having different policies that allow transactions to be made without an SSN or TIN

Advantages of a 30% tax on international remittances

A positive outcome of implementing the proposed measures would likely be that migration of poorly qualified people would be discouraged. These individuals are often motivated by the prospect of social benefits and earnings that are unavailable in their home countries, which lack investment in services and infrastructure due to government corruption.

“Those are inefficient governments, blinded by corruption, whose problems we cannot assume or pay for,” he warned.

He added to Trump and officials at the Department of Homeland Security and ICE, “The culture these immigrants come from often prioritizes personal gain over public welfare. Conversely, our society has an obligation to care for veterans who have fought for our freedom and peace. Many of them live without psychological or material support, and hundreds commit suicide. Meanwhile, the illegals make easy money, build wealth, and strengthen the economies of their countries.”

According to Saraiva, thousands of pensioners in the U.S. face hardships, and even children are deprived of better services in public education systems, overloaded with undocumented migrants. “Wouldn’t it be reasonable to raise the taxes over international remittances to 30%, to help minimize so many losses?”

“The fact is that the vast majority of immigrants arrive in the U.S. without a desire to contribute to society and neither do they understand and respect our values. On the contrary, they bring criminality, harm the environment, and escalate violence, drug use, and other practices typical of underdeveloped societies, weakening us as a nation while creating a sense of collective insecurity and psychosocial unease. The worst part is that, after crossing our borders like starving rats, they dare claim they have built this country, even though they’ve earned salaries many times higher than what they made in their home countries. Is this surrealism, a bad joke, or an unacceptable reality that must be corrected immediately, lest we be called fools, as recently pointed out by Vice President JD Vance?”

The full content of the message

President Donald Trump

The White House

1600 Pennsylvania Avenue

Washington D.C

CC:

Honorable Secretary ELON MUSK

Department of Government Efficiency (DOGE)

Honorable Secretary Kristi Noem

Department of Homeland Security – DHS

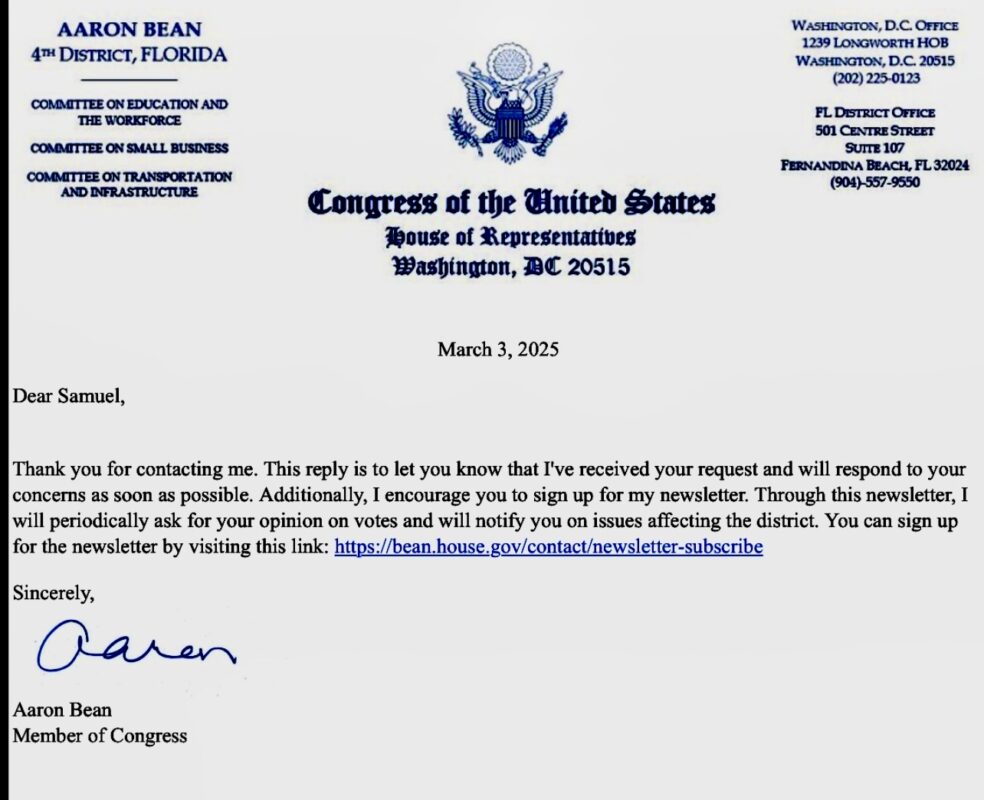

The Bipartisan House Caucus

Co-Chairman Aaron Bean

Co-Chairman Pete Sessions

Co-Chairman Blake Moore

Summary: Proposes technical studies for the development of federal legislation or executive measures that establish in the United States a permanent fee of 30% on all individual international remittances above 200 USD per month. The revenue generated from this measure should be allocated to the ICE and other internal security agencies, to be applied in operations concerning detention, intelligence, custody, prosecution, and deportation, as well as in salary bonuses for law enforcement agents.

URGENT

March 1st, 2025

Dear President Trump,

Inspired by an accurate reading of reality and the awareness of the responsibilities inherent to citizenship, the proposition presented here is supported by undeniable practicality and historical reasoning, with robust solidity and legitimacy.

In addition to being the most financially powerful man on the planet, he is essential for the realization of President Trump’s MAGA dreams, for the happiness of the American people, both to reduce unnecessary expenses and increase revenue. I request you to please share this humble patriotic suggestion with our President.

It is a fact that much of the money sent abroad in personal remittances originates from illegal activities, as a large proportion of immigrants lack a permit to work in the United States.

The Inter-American Dialogue reports a 26% increase in the value of personal remittances sent by foreign residents in the United States, since it surpassed $134.4 billion in 2021. A reasonable projection suggests that this amount today could easily exceed $200 billion.

Nothing would be fairer than taxing personal remittances and using these funds to improve the training of our agents, provide them with better equipment, and financially compensate thousands of public servants who perform commendable duties under significant risk and sacrifice, receiving insufficient remuneration for their efforts.

Tax evasion seems to be in the DNA of people from less developed cultures, where both citizens and their representatives prioritize individual interests over collective aspirations. This explains why nations with immense developmental potential remain trapped in chronic poverty for centuries.

Although some studies indicate that a significant portion of tax revenue derives from illegal labor, the amount of evaded taxes is presumably incalculable due to the volume of cash payments fueling the informal economy. This causes severe losses to the national tax system while underscoring the urgent need for adjustments to fiscal systems, ensuring they operate equitably, fairly, and sustainably at the federal, state, and local levels.

The concerning reality clearly illustrates how tax evasion affects people of various income levels, races, and ethnicities, impeding the fulfillment of our social needs.

Moreover, it is worth noting that the United States leads global rankings for fiscal evasion, meaning a staggering amount of wealth is being taken abroad.

Credible reports indicate that, worldwide, undocumented individuals moved over $831 billion in international remittances in 2022, much of which was earned by immigrants lacking authorization to work legally in the U.S.

It is essential to find ways to eliminate the current possibility of making international remittances without providing a Social Security Number (SSN) or Taxpayer Identification Number (TIN), whether through wire transfers or transactions involving cards and cryptocurrencies. Some services allow money to be loaded onto prepaid debit cards, which can then be used in international transactions. For those familiar with digital currencies, sending cryptocurrencies abroad is an option that often does not require an SSN. A parallel challenge is to prevent local money transfer services from having different policies that allow transactions to be made without an SSN or TIN.

Advantages

A likely positive outcome of implementing the proposed measures would be that migration of poorly qualified individuals would be discouraged, as they are often motivated by the prospect of social benefits and earnings unavailable in their home countries—countries lacking investment in services and infrastructure due to government corruption. We have no reason to pay for the mismanagement and failures of other nations.

The culture from which these immigrants come often prioritizes personal gain over public welfare. Conversely, our society has an obligation to care for veterans who have fought for our freedom and peace. Many of them live without psychological or material support, and hundreds commit suicide. Pensioners face hardships, while our children are deprived of better services. It would therefore be reasonable to increase the taxes on international remittances to 30%, mitigating the losses accumulated over several decades.

The fact is that the vast majority of immigrants arrive in the U.S. without a desire to contribute to society and neither do they understand and respect our values. On the contrary, they bring criminality, harm the environment, and escalate violence, drug use, and other practices typical of underdeveloped societies, weakening us as a nation while creating a sense of collective insecurity and psychosocial unease. The worst part is that, after crossing our borders like starving rats, they dare claim they have built this country, although they arrived here to earn many times what they made in their home countries, and finding a fully established infrastructure ready for use. They are rewarded—and well rewarded—for their work.

For these reasons, I believe it is a matter of justice to establish a 30% tax on individual international remittances, in order to serve national interests.

I take this opportunity to express my gratitude for your potential consideration of this suggestion and to offer my full availability, hoping for the absolute success of your efforts to Make America Great Again.

Sincerely,

Samuel Sales (Saraiva)

U.S. Citizen – Journalist

Contact:

E-mail: samuelsalessaraiva@gmail.com

Cell: 202 999 9078